L3 Technologies is an aerospace and defence company. It specialises on Intelligence, Surveillance, and Reconnaissance (ISR) programs, and communications, network, and electronic systems. The company’s main customers are the United States military, domestic security agencies — such as the FBI, Transportation Security Administration (TSA), Federal Aviation Administration (FAA), and the Department of Homeland Security (DHS) — and the commercial aviation sector.

More specifically, L3 Technologies designs advanced systems on aviation security, pilot training, maritime security, night vision and infrared (IR) optical devices, and space defence and exploration.

The company consistently wins competitive contracts to design, upgrade, or produce products for the military. Only recently, a subsidiary of L3 Technologies, Security and Detection Systems, won an Army contract to manufacture and support the AN/PSS-14 individual mine detection system. The AN/PSS-14 will contain a metal detector, ground radar, and microprocessor software that will enable it to detect both antipersonnel and antitank mines. The prominence of Improvised Explosive Devices (IEDs) on modern battlefields has necessitated the constant evolution of detection systems. The choosing of L3 by the U.S. Army testifies to the company’s excellent credentials. The contract is worth $84 million.

Another contract that a subsidiary of L3 Technologies won recently is for the United States Marine Corps’ (USMC) next Unmanned Underwater Vehicle (UUV). L3 OceanServer will design and produce an updated version of its Iver3 Unmanned Underwater Vehicle (UUV). The Iver3 is a commercial UUV outfitted with an array of sensory equipment, for example, side scan sonars and inertial navigation systems, and used to conduct underwater surveys, environmental monitoring, and subsurface security operations. The USMC will employ the military version of the Iver3 for Mine Countermeasure (MCM) and littoral hydrographic operations. (It is worth noting that L3 OceanServer has already produced dozens of Iver UUVs for the U.S. Navy.)

Earlier this year, L3 Technologies also won a contract to design, develop, and manufacture a novel communications data-link system for the Navy’s newest Littoral Combat Ships (LCS). Until now, LCSs could only receive surveillance information from only one aerial asset — i.e., airplanes, unmanned aerial vehicles (UAVs), and helicopters — at a time. The new system that L3 Technologies is developing, however, will enable LCSs to receive and process imagery from multiple aerial assets simultaneously. This was a heavily contested contract, given the battlefield conditions that LCSs would operate in. In a possible conflict with China, for example, the littoral capabilities of the LCSs would be invaluable to the Navy. Having, thus, the ability to process numerous surveillance reports at the same time (e.g., warnings of incoming Chinese anti-ship missiles) would increase the survivability of the ships and, consequently, their operational value. The Navy’s confidence in L3 Technologies for such an important contract highlights the company’s credentials and future potential.

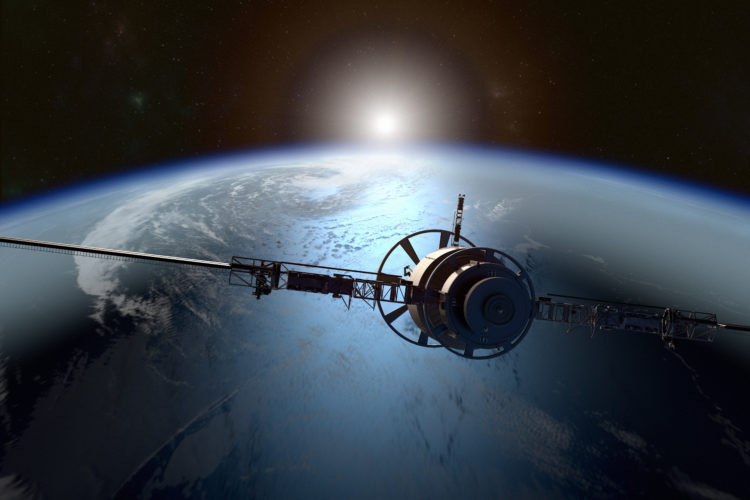

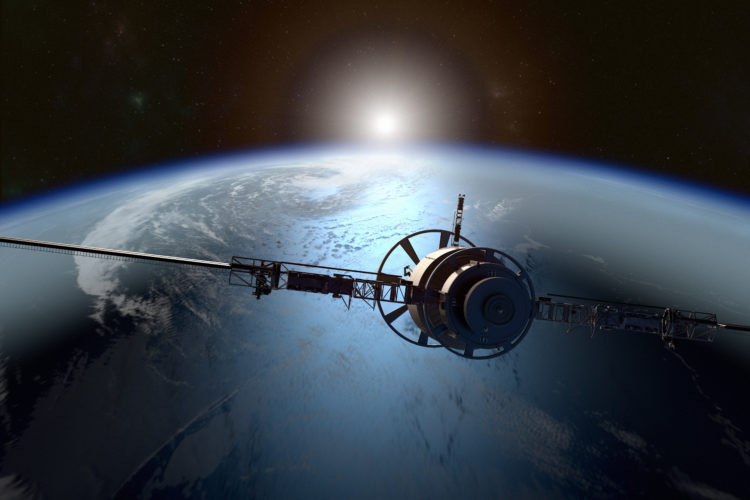

But L3 Technologies pursues a large portfolio of contracts. This month, for example, the company announced that it came into agreement with Intelsat, a communications satellite provider, to market the FlexAir system to the U.S. FlexAir is high-end broadband service for ISR operations and in-flight communications for military and commercial aircraft. L3 Technologies will receive access to Intelsat’s large satellite fleet and thus be able to provide its customers — whether it is the Department of Defence (DoD) or an aviation company — with fast and reliable broadband connectivity.

Yet L3 Technologies does not rest on its laurels, and continuously seeks ways to remain one step ahead of the competition. Earlier in December, the company announced a merger with Harris Corporation, a tech firm specialising in information technology (IT), that produces, among others, electronic warfare systems, telecommunications systems, and space satellite equipment. The new L3 Harris Technologies will be among the top-10 largest defence companies in the world. Moreover, the merger deal would be the largest ever — in terms of market capitalisation — to have happened in the industry. And the plan is to invest a considerable portion of revenue ($300 million, or 5 percent) into Research and Development (R&D).

During the 2017 Fiscal Year, L3 Technologies reported sales worth $9.6 billion. For the 2018 Fiscal Year, that number was around $10.8 billion. The company stock has had a 12 month low of $172.54 and high of $223.73. Recently, the stock price has been orbiting at the $180-190 range. So, there is ample opportunity for the stock to rise. Recently, Barclays and JPMorgan Chase & Co. reported a target price of $220 and 245 respectively for the L3 Technologies’ stock.

The consistent trust of customers such as the DoD and commercial aviation industry suggests that L3 Technologies is a reliable and capable provider of high-quality services and technology and thus an integral player in the aerospace and defence industry. The planned increased spending by the current administration means that the company will have more opportunities to compete and win contracts.

Already have an account? Sign In

Two ways to continue to read this article.

Subscribe

$1.99

every 4 weeks

- Unlimited access to all articles

- Support independent journalism

- Ad-free reading experience

Subscribe Now

Recurring Monthly. Cancel Anytime.

COMMENTS