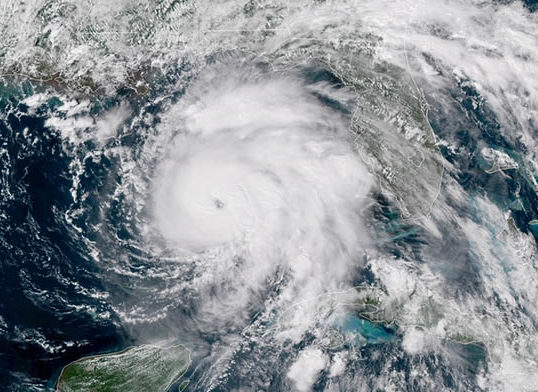

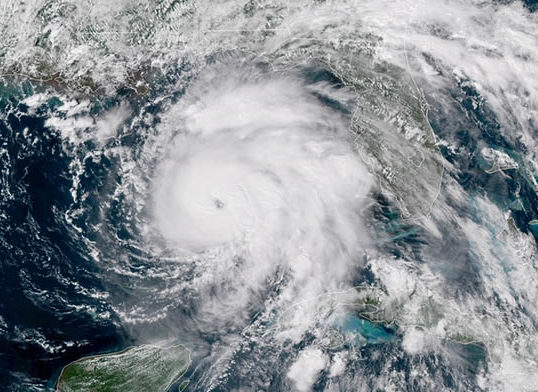

Hurricane Michael, a powerful category 4 storm, is on a collision course with the Florida Panhandle. The storm is expected to make landfall sometime on Wednesday. According to a report from The Weather Channel, this is the first category 4 storm to strike the area in recent times. It will produce life-threatening winds and storm surges.

“I’ll tell you to go back to the records to 1851, and you can’t find a category 4 in the Panhandle, so this is an unprecedented event,” said Director of the National Hurricane Center (NHC) Ken Graham.

While the storm will likely cause significant damage to homes and buildings in the affected area, Michael will also be felt throughout the country’s financial markets. According to a report from Bloomberg, experts are predicting the hurricane to cause “$16 billion in damage.” Home building companies, hospital firms, major retailers, and the energy sector are some of the industries that will be most affected by the storm.

Stocks of Pulte Homes, Toll Brothers, NVR Inc., and Beacon Roofing Supply were all up on Wednesday morning. According to Bloomberg, companies that specialize in construction supplies, such as timber, are also expected to rise as demand increases. However, as damage estimates range on the tens of billions and push construction stocks up, shares of insurance companies, such as Chubb and Allstate, fell in expectation of the flood of insurance claims that will come after the storm.

The Hospital Corporation of America (HCA), which operates several hospitals in the affected region, saw a drop of 0.5 percent. Some experts are concerned that if the damage to the area is severe enough, many patients will cancel their elective procedures, which have traditionally boosted healthcare corporations’ stock prices in the fourth quarter. Aside from the long-term consequences, the facilities in the path of Michael may be damaged significantly enough to affect operations.

Energy may also take a hit from Michael. According to a report from The Street, many oil platforms in the Gulf of Mexico have already been evacuated. As a result, oil prices rose slightly on Wednesday; however, many experts expect the long-term effects of the storm to be negligible.

“It’s not going to hit critical infrastructure in Texas like Harvey did,” said Jeanette Casselano, spokeswoman for the American Automobile Association (AAA).

Local gas prices in the Panhandle are also expected to rise as supply becomes an issue. However, according to AAA, a price increase at the pump has been anticipated due to the uncertainty facing crude oil.

“Crude oil accounts for half of the retail pump price and crude is selling at some of the highest price points in four years,” said Casselano. “That means fall and year-end prices are going to be unseasonably expensive.”

Already have an account? Sign In

Two ways to continue to read this article.

Subscribe

$1.99

every 4 weeks

- Unlimited access to all articles

- Support independent journalism

- Ad-free reading experience

Subscribe Now

Recurring Monthly. Cancel Anytime.

COMMENTS