On Wednesday, the Federal Reserve released the minutes of the September 25-26 quarterly meeting of the Federal Open Market Committee (FOMC). The summary showed that officials anticipate the meeting’s (quarter percent) rate hike to the central bank’s benchmark federal funds rate target to be followed by another increase at the end of the year, and at least three more in 2019. Fed officials continue to describe interest rates below a neutral rate that will neither stimulate nor depress economic activity, but dropped the term “accommodative” as a descriptor for these low rates. This is a continuation of what has been a good start for the Fed in its attempt to normalize monetary policy. Notwithstanding criticisms from politicians on both sides of the political aisle, the central bank should at the very least continue on its present course. The sheer enormity of the Fed’s expansionary policy in the wake of the 2008 financial crisis makes it all but certain that there will be a correction eventually, but continuing to normalize now will at least speed the re-calibration that is to come.

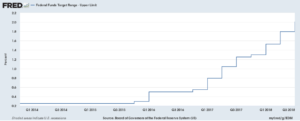

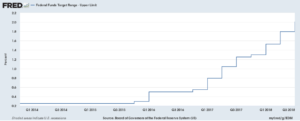

The Fed’s September increase continues the tightening that has been the Fed’s policy since late 2015. In the fourth quarter of that year, nominal interest rates were near zero, and, even with negligible inflation, real rates had turned negative. Today, the target federal funds rate is just over 2%.

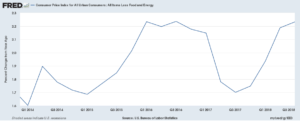

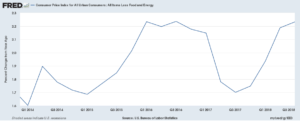

The two percent level is on par with the moderate rate of inflation in the economy — inflation stands at just over 2% for Q3 2018, and two percent inflation is the Fed’s target rate (theoretically, at least) for accomplishing its dual mandate of balancing inflation and unemployment.

President Trump offered a criticism of Fed policy that is in line with his past thinking on the subject at certain times (2:17) — Trump has, in the past, stated that he is “a low interest rate person” — but at others the President has made the argument that low interest rates are bad for the economy because they perpetuate artificial bubbles. This time, according to CNBC, the President was “not thrilled” about the continued rate hikes. The President said that he had hoped the Fed would do “what’s good for the country,” and that he should be “given some help by the Fed” by way of a more accommodating interest rate policy.

Despite the President’s criticisms, the Fed’s policy of tightening is about more than the abstracts of balancing inflation and a booming job market. Throughout the 2008 financial crisis, and for several years thereafter, the central bank departed from its traditional open market operations and embarked on the unprecedented policy of accumulating trillions in securities through open market operations — and not just treasuries, but also defunct paper, such as overvalued agency mortgage-backed securities (held by Fannie Mae and Freddie Mac). The Fed’s open market operations during this time had the dual effect of increasing the “base money” in the US banking system and purging both credit markets and the federal government’s balance sheet of the overvalued mortgage backed securities that had crashed in the run up to the crisis. In all, from December 2007 to September 2015 the Fed increased its balance sheet holdings from $879.4 billion to $4.5 trillion — it did so by purchasing $2.4 trillion in treasury debt and $1.7 trillion in defunct agency mortgage backed securities, the latter, again, having already been purged from the credit markets by government sponsored enterprises (GSEs) Fannie Mae and Freddie Mac.

The Fed’s current interest rate policy therefore works together with its unwinding of its balance sheet to (hopefully) return the operation of credit markets to a dynamic, better approximating real market conditions. So long as the Fed holds trillions in obligations, market forces cannot operate concordant with the real supply of — and demand for — credit in the economy; so long as the Fed keeps such a massive balance sheet, it will continue to hold down interest rates and thereby facilitate the perception that there is a greater supply of credit on the market than there actually is. This, in turn, will incentivize a level of borrowing for long-term capital investments that surpasses the real resources available to bring every investment to completion.

Eventually, the story goes, too many bricklayers will need bricks with which to build their homes, and too few will have foregone the purchase of bricks in lieu of saving in the credit markets. These potential savers, too, are in the market for bricks, whereas artificially low interest rates sent the signal to builders that there would be room enough for all. Instead, the market is crowded, the price of bricks is bid up, and builders who cannot absorb the unanticipated increase in the cost of construction go out of business. And so, in allegory as in our own time, the folly of one policy too long perpetuated cascades into crisis and the bust makes its way into the financial system generally, by way of the underwriters of failed projects and investors convinced of the inevitability of future returns.

Quantitative easing may have been necessary as an emergency measure to stave off collapse a decade ago. Near-zero targeting for the federal funds rate, too, may have been prudent as an emergency measure, but relying on the Fed to hold onto its trillions in accumulated assets in perpetuity is folly. The inevitable can only be held at bay for so long before crisis strikes again, and while we may today chide officials at the central bank for their hesitancy in the face of the mere specter of inflation, those fears will find a corporeal manifestation all too quickly if we do not continue, and perhaps accelerate, our present course. That is not to say that inflation will not come, or that a correction in the face of false signals from a decade of near-zero interest rates can be totally avoided, but choosing to continue such a radically dovish Fed policy for years to come is to accelerate down the road to perdition with eyes wide open and the reality of the destination on the mind.

Already have an account? Sign In

Two ways to continue to read this article.

Subscribe

$1.99

every 4 weeks

- Unlimited access to all articles

- Support independent journalism

- Ad-free reading experience

Subscribe Now

Recurring Monthly. Cancel Anytime.

COMMENTS