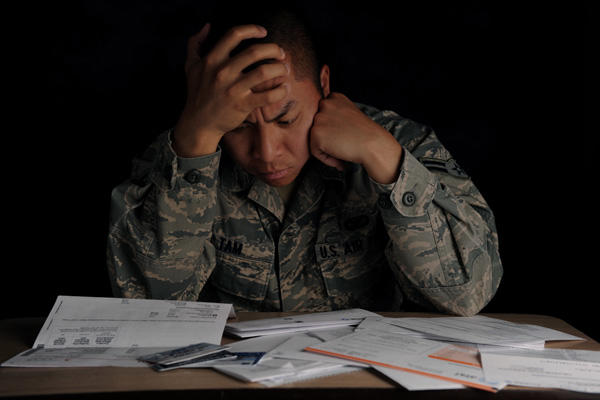

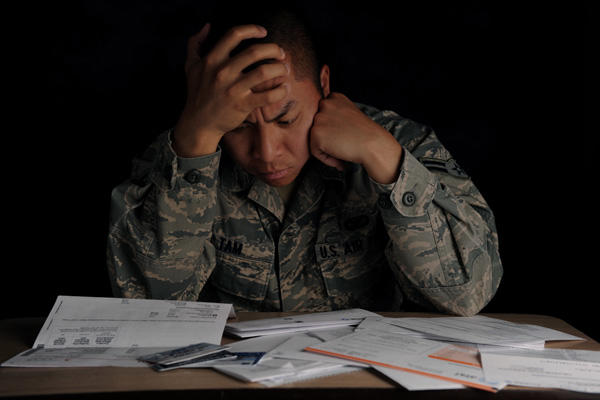

While the Social Security deferral was nice while it lasted, junior soldiers will now feel the pain of repayment.

Let’s say you are a Private First Class in your early 20s, with multiple children, and have been in the military for just two years. The Basic Pay for a PFC with two years is only a mere $1,900 a month.

For that soldier to not having to pay his social security for three months was great, especially during this time of the year.

Now, starting in January, soldiers will go back to paying their six percent in Social Security and another six percent for three months to pay back the deferral.

That could be hundreds of dollars of their pay in December. And for the PFC above with multiple children, this could be devastating.

Social Security (Old Age, Survivors, and Disability Insurance) or “OASDI” tax withholdings were deferred effective September through December 2020 for those military members with a monthly rate of basic pay of less than $8,666.66 and for civilian employees who had wages subject to OASDI of less than $4,000 in any given pay period. So, essentially, for most of our military.

This measure was in response to the Presidential Memorandum issued on August 8, 2020, the Internal Revenue Service Notice 2020-65 issued August 28, 2020, and at the direction of the Office of Management and Budget and the Office of Personnel Management.

In President Trump’s direction, this order was to provide relief during the COVID-19 pandemic by increasing disposable income.

“Today, I am directing the Secretary of the Treasury to use his authority to defer certain payroll tax obligations with respect to the American workers most in need. This modest, targeted action will put money directly in the pockets of American workers and generate additional incentives for work and employment, right when the money is needed most,” President Trump’s memorandum had stated.

Per IRS guidance, the Social Security taxes deferred in 2020 will be collected from pay between January 1 and April 30, 2021.

Wait, couldn’t the soldiers have declined the deferral? No!

According to Defense Finance and Accounting Service (DFAS) the Office of Management and Budget directed all Executive Branch Agencies to implement the tax deferral. As such, no Payroll Providers, Departments/Agencies, employees, or service members were able to opt-out or opt-in of the deferral.

In a 2017 survey, Career Builder, a leading job site, found some startling statistics related to debt, budgeting, and making ends meet. Twenty-eight percent of workers making $50,000-$99,999 usually or always live paycheck to paycheck; 70 percent of them are in debt. The survey also found that only 32 percent of the nearly 3,500 full-time workers surveyed budget and 56 percent save only $100 or less a month.

Already have an account? Sign In

Two ways to continue to read this article.

Subscribe

$1.99

every 4 weeks

- Unlimited access to all articles

- Support independent journalism

- Ad-free reading experience

Subscribe Now

Recurring Monthly. Cancel Anytime.

COMMENTS